Tap the power of AI to drive strategic insights and strategy

The accounting profession is undergoing a dramatic transformation as artificial intelligence and intelligent process automation become central to daily operations.

Processing Content

While the promise of AI — greater efficiency, accuracy and cost savings — is well understood, the impact on accounting roles, staffing models and career paths is just beginning to take shape. Two key trends are emerging: a decline in traditional, task-based roles and a surge in demand for professionals who can interpret AI-driven insights and guide business strategy.

Accounting roles that rely heavily on data entry, manipulation and reporting, such as accounts receivable and accounts payable specialists and accounting clerks, are declining. Driven by the rapid deployment of intelligent process automation in areas like invoice matching, cash application and transaction processing, tasks that once required hours of manual work can now be completed in seconds by AI-powered systems, which reconcile accounts and flag exceptions for human review.

The numbers tell the story: 34% of accounting leaders already use AI in production or are scaling AI usage in AP and account reconciliations. Another 33% have AI pilots underway for error and anomaly detection, while 56% have AI implementations planned for report creation and 41% have pilots planned for augmented analytics. This proliferation of AI is fundamentally changing how accounting and finance roles are staffed, structured and executed.

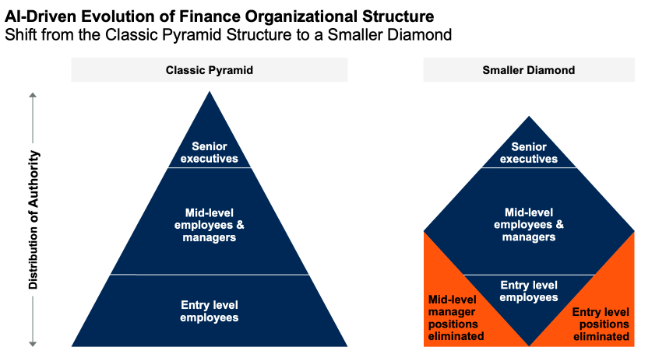

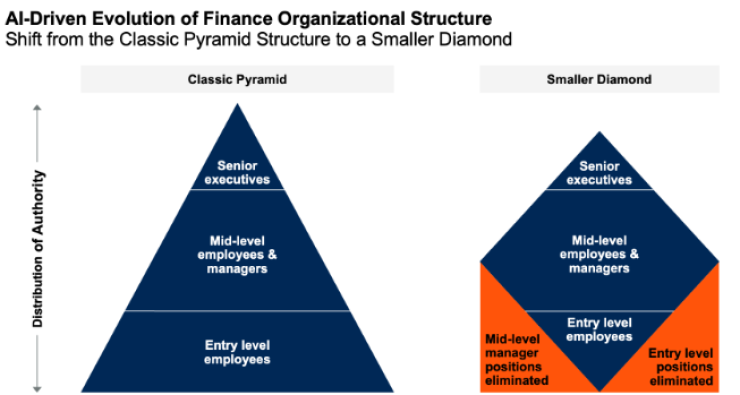

Research from MIT Sloan and Stanford University shows that accountants using generative AI can upgrade the level of detail in financial reports by 12%, shift 8.5% of their time from back-office processing to more productive work and cut 7.5 days off the monthly financial close. As a result, 24% of accounting executives anticipate headcount will decrease by 6% to 15% in the next three years, with another 11% expecting a decrease of up to 25%. The classic bottom-heavy talent pyramid is giving way to a diamond-shaped structure, with fewer entry-level roles and a greater emphasis on skilled individual contributors, in the middle of the diamond, who can leverage AI tools.

Source: Gartner (January 2026)

The rise of the AI-enabled accountant

While automation reduces the need for traditional roles, it also creates new opportunities for accountants who can blend technical, analytical and business skills. As AI becomes more integral to accounting operations, professionals must learn to operate sophisticated tools, interpret outputs, and enable earlier risk detection and real-time decision-making. AI isn’t replacing accountants per se, but accountants who use AI will replace those who don’t.

AI advancements in three key areas require corporate controllers to implement a hybrid operating model, balancing automation and human intervention, and changing accounting jobs. Where AI becomes integral to accounting operations, accountants must operate sophisticated AI tools and/or interpret their outputs.

1. Continuous data flows and autonomous accounting: The accounting process is becoming increasingly autonomous as data flows are automated and updated in real time. Accountants are now expected to understand technology options, target the most time-consuming close processes for improvement and minimize drag on the overall process.

2. Anomaly and error detection: AI-enabled anomaly detection tools are making accounting processes more reliable by automatically flagging irregular transactions. Instead of spending time on manual classification and error correction, accountants are shifting their focus to interpreting AI-generated red flags, refining controls and procedures, and forecasting future fraud risks or operational issues. This transition requires a deeper understanding of both technology and business processes.

3. Enhanced business partnership and analytics: With technology handling high-volume, repetitive tasks, accountants can spend more time interpreting data, identifying problems and making complex decisions. AI is used to analyze historical financial data, test management assumptions, perform detailed credit risk evaluations, and inform cost-related decisions. The result is a stronger partnership between accounting and the broader business, with accountants providing forward-looking insights that drive value.

Preparing for the future: redesigning roles and career paths

As AI adoption accelerates, corporate controllers must rethink their team structure. The defining characteristics of future accounting roles will be a blend of accounting expertise, advanced digital skills, analytical prowess and a collaborative approach to working with AI. More than 60% of accounting executives expect to realize cost savings from less dependence on human labor, but they also anticipate richer data insights and a greater need for skilled talent. To prepare, controllers should:

- Evaluate near-term job changes and the level of AI-driven disruption for each role and think about what entry-level roles will look like in future with many traditional entry-level tasks being automate;

- Identify new responsibilities for accountants and revise role profiles accordingly;

- Build experience-based career maps that provide on-the-job development in areas like process automation and financial data analysis; and,

- Use criticality planning to determine which roles to hire for now and which to develop internally for the future.

By taking these steps, accounting leaders can ensure their teams are ready to thrive in an environment where AI is not just a tool, but a collaborative partner in delivering business value.

AI is reshaping the accounting function from the ground up. While automation is reducing the need for traditional data entry and processing roles, it’s also elevating the importance of analytical, digital and strategic skills. The future of accounting will be defined by professionals who can harness AI’s power to drive insight, efficiency and growth, transforming the function into a strategic business partner.