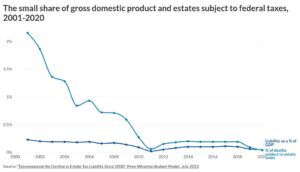

Clients aren’t likely to face estate taxes. But they still need a plan

The political calculus involved with the details of estate planning next year and beyond may be distracting financial advisors and clients from a larger, simpler conversation, one expert says. On the off chance that the federal estate-tax exemption levels of $13.99 million for individuals (and double for couples) revert to