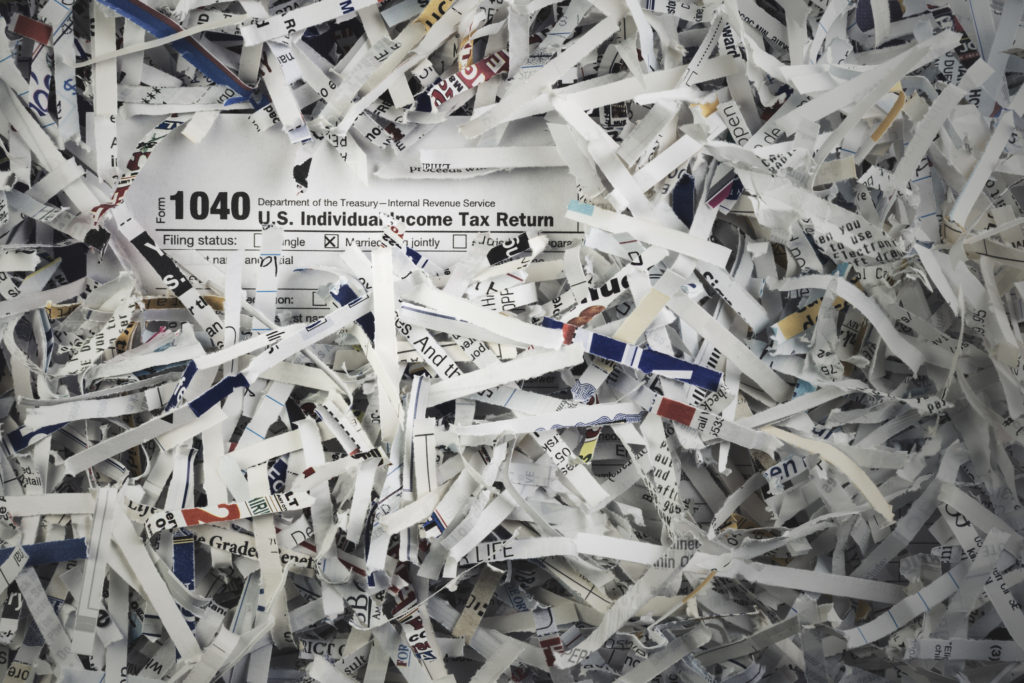

What to Know about Form 1040 Identity Theft

“Now is the winter of our discontent” is the famous soliloquy spoken by the Duke of Gloucester as the opening line in William Shakespeare’s “Richard III.” Add to the roster of the discontented IRS Commissioner Charles P. Rettig, according to several New York Times articles published this year. That’s because he exhorted his staffers to clear a backlog of more than 20 million unprocessed tax returns from 2020 and previous years for the 2022 tax season.

IRS officials described his homily as “all hands on deck,” intended to encourage the agency to emerge from “longstanding staffing shortages that were compounded by the pandemic,” according to the Times. (Our lawmakers decided that the IRS should become “the main distributor of stimulus relief, including direct checks and tax credits.”) Rettig’s lugubrious advice for traumatized taxpayers: File online and supply direct deposit information to receive refunds as promptly as possible. Use the agency’s online resources for answers to questions.

Something that merits mention: nothing was mentioned about tax identity theft schemes by the Times and, particularly, Rettig. After all, a media-savvy IRS often announces that one of its top priorities is combatting criminals who steal tax-related information. While the IRS has made significant progress in combatting tax identity theft, resourceful identity thieves remain active and constantly introduce new schemes. One of their popular ploys: Use stolen Social Security numbers and other information to file fraudulent 1040 forms that claim hefty refunds––claims criminals generally submit at the start of the filing season.

Here are some reminders for taxpayers on what to do during the 2023 filing season when they submit 1040s for 2022. Most are unaware that the law says it’s completely kosher to avail themselves of a simple, perfectly legal way to thwart these thefts––file 1040s that show balances due.

How to do that? First, employees who receive wages that are subject to withholding for income taxes could decrease withholding by revising their W-4 forms, Employee’s Withholding Certificate. Employees who select that route and need the W-4’s most recent version should ask their accountants or go to the IRS’s website, where they also can check out the IRS’s Tax Withholding Estimator for help on how to complete a W-4.

Second, self-employed individuals who make quarterly payments of estimated taxes could decrease those payments.

Third, retirees who supplement their Social Security with pensions from former jobs and money they remove from their IRAs, 401(k)s and other tax-deferred retirement plans could decrease their estimated payments. Some retirees could even skip their estimated payments entirely while also boosting withholding from their pensions, annuities, Social Security benefits and distributions from retirement plans.

How badly can things turn out when they don’t decrease withholding or estimated payments and instead file 1040s that claim refunds? Taxpayers whose identities have been stolen may receive impersonal responses from the IRS. The agency might word them like this: “We previously received a 1040 showing your name and Social Security number and claiming a refund. Alas, we paid it.”

Be patient while an agency long understaffed and underfunded and more recently overwhelmed by the pandemic undertakes what could prove to be an interminable investigation. While you should eventually get the refund to which you’re entitled, it will be injurious to your health if you inhale and remain that way until that happens.

An alternate scenario: Savvy taxpayers submit 1040s that are accompanied by checks for amounts due. By the time their genuine returns reach the IRS, it already received fraudulent ones that show their names and Social Security numbers and claim refunds that a snookered IRS promptly paid. How do things turn out when it’s a balance-due scenario? The IRS sends terse responses worded like this: “We’ve already received your returns, or so we thought. Still, we’ll accept them and cash your checks.”

Rettig’s sleuths then track down the thieves, which isn’t a concern for balance-due filers, though it’s prudent for them to determine whether the thieves accomplished other schemes––for instance, obtained loans or made purchases in their names. This would be a good moment to check their credit reports. The IRS’s Publication 5027, Identity Theft Information for Taxpayers, available at irs.gov, mentions, among other things, what taxpayers should do to avoid becoming theft victims.